Whether you’re behind the wheel of a heavy-duty truck or responsible for loading its freight, each member of the transport supply chain has a responsibility to keep each other safe.

Risk management and insurance go hand in hand, and we should all collaborate to reduce the hazards facing drivers each day. But has the pressure for efficiency curbed our focus on safety? Here are some critical safety reminders and digital tools that can help us recalibrate and work towards getting everyone home safe and well, every trip.

Chain of Responsibility (CoR) legislation

As a party in the supply chain, you have a legal duty to manage risk. More specifically for business owners and leaders, you must abide by Chain of Responsibility laws as you are considered an “influencing person”.

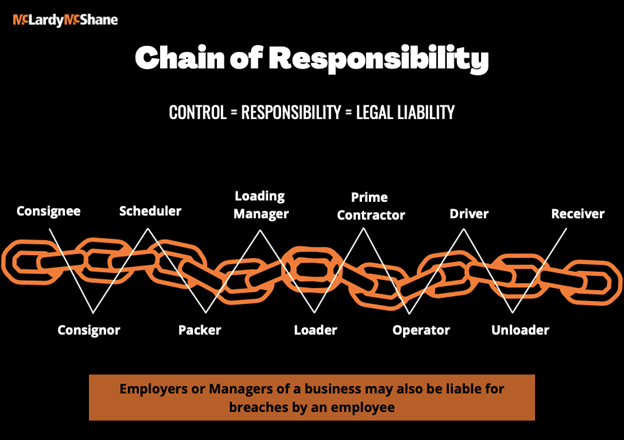

The ‘chain of responsibility’ principle affects all parties involved in the transport chain. Any person or entity with control or influence over transport activities could be considered liable for actions or inactions that cause or contribute to a road safety breach.

Those responsible and therefore liable are shown below:

Risk management techniques

With such a range of complex risks while on the road, it’s paramount that organisations and individuals collaborate to reduce the hazards facing drivers each day.

Government investments into road safety projects are always welcomed by the industry and the team at McLardy McShane. The Road Safety Innovation Fund, which targets projects designed to reduce fatal and serious road crashes, has recently announced its $10million investment into 40 life-saving projects. These range from testing new ways to detect risks for vulnerable road users, to funding innovation and technology to reduce risk-taking behaviours.

If you are a consignee, receiver, or anything in between, you should be familiar with the ways you can reduce risk at your end. This could include:

- Curbing unsafe driving behaviours: Speeding and skipping breaks are tell-tale signs of a driver trying to get the job done faster. Consequently, fatigue is often inevitable, causing slower reaction times and a greater risk of collision. If you are a supply chain member adding time pressures to your driver, consider how this can increase a huge array of life-threatening risks.

- Never skip necessary procedures: If you are a manager, you might feel pressure to have your vehicles on the road as much as possible. But this “time is money” outlook can be fatal. It’s not uncommon for drivers to receive inadequate training when first employed or necessary vehicle upgrades and maintenance being overlooked- pushing the barriers of safety.

- Keep your load in check: Loose or incorrectly restrained loads can cause serious crashes which could injure or kill someone, damage property or cause a hazard to other road users. All heavy vehicle drivers and those in the transport supply chain have a legal responsibility to ensure that loads are securely restrained.

Technology as an aid in transport risk management

While digital safety programs have been around for some time, more and more elements of driver risk management are shifting to digital. The transportation industry is already utilising digital tools to manage driver risk.

Telematics can collect and analyse driver behaviour data. This can include acceleration, braking, speeding, and distraction. This software can be smartphone-based, eliminating the need for in-vehicle installation as they can move with the driver in between vehicles. This data can be used to identify drivers who need additional training, improving their driving and reducing incidents over time.

The recognition of the link between driver wellbeing and overall safety has shaped industry innovations. For example, Seeing Machines technology scans the driver’s face for signs of early-onset fatigue and distraction. It then alerts the driver, reducing the immediate risk, and records the incident, providing valuable data that can be used later for driver training.

Transport insurance market

The transport industry is vital to the Australian economy, making it essential to get vehicles back on the road as quickly as possible should the unexpected happen.

As the industry continues to become more heavily regulated, appropriate coverage is vital for transport companies across the country. CoR laws have put a duty on each supply chain member to ensure that requirements are met.

Australia’s transport and logistics insurance market is constantly evolving. While providers are changing their offerings to better meet the needs of consumers, a hardening market, combined with regulatory changes and COVID-19’s influence has seen premium prices increase in many areas.

These unique circumstances indicate that it’s more important than ever to choose an experienced Australian insurance broker, to provide advice and remain close to clients during these unprecedented times.

How we can help

While it is crucial to review and update your risk management strategy regularly, you should also have the appropriate insurance solution in place as a safety net.

McLardy McShane can tailor a transport and logistics insurance solution for you. We have significant industry expertise, decades of experience and an ever-expanding knowledge of the local transport insurance market.

Learn how you can keep your business safe, secure, and protected by contacting us today.

General advice warning

This material provides general information only and does not consider your individual needs, objectives, or financial circumstances. Before making any decisions, you should assess whether this material is appropriate for you and obtain financial and/or legal advice tailored to your situation.